Wall Road is celebrating Hasbro’s newest earnings report. The corporate posted an working revenue of $116.2 million. The inventory value is up by virtually 12% as I write this. And then you definitely have a look at the report and also you marvel what on earth these individuals are partying over. And Star Wars? Not price a point out in any respect. You need to know why Hasbro now not talks about Star Wars? Click through for more!

Hasbro CEO Chris Cocks on the earnings presentation (image photograph)

Now Wall Road solely appears at earnings and dividends and Chris Cocks is stuffed with reward of his “Operational Excellence” (aka we fired 1000’s of individuals) that sees the corporate again on observe. And certain, an working revenue of $116.2 million is a big enchancment over the yr prior.

However then you definitely have a look at the report intimately and also you marvel… that is what Wall Road is partying over?

Total income is down one other 24%. Even should you regulate for the sale of eOne and the income decline attributed to the sale, income continues to be down 9%. The Client Merchandise phase (aka “toys” and “video games” the issues a toy firm is often recognized for) is down 21%, and this phase studies a lack of virtually $47 million for the quarter. Hasbro says “broader trade traits” are accountable.

The truth is, virtually the one factor conserving Hasbro afloat is as soon as once more the huge Magic The Gathering / Dungeons & Dragons enterprise, this phase additionally has an working margin of 38.8%. What any firm goals of. Which suggests it’s mainly the one worthwhile enterprise Hasbro at the moment has. Printing overpriced buying and selling playing cards prices little cash in spite of everything. Ought to for any motive the buying and selling card enterprise ever collapse (no signal of that but) Hasbro could be in serious trouble although.

And Star Wars?

Like final time Hasbro didn’t point out Star Wars even as soon as. Marvel wasn’t talked about both btw.

The explanation?

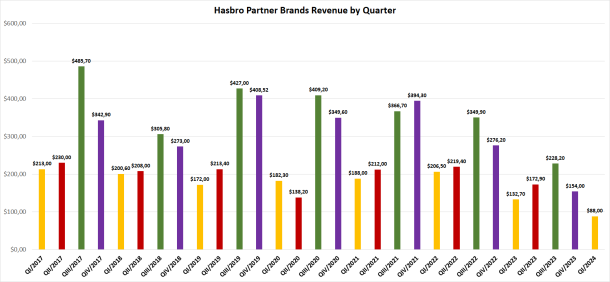

The associate manufacturers phase is down by one other 34% after an already actually dangerous final yr and Q1/2023. It’s now simply $88 milion vs $133 million in Q1/2023. The truth is, the reported $88 million is the bottom end result for the licensed associate manufacturers phase since mainly perpetually. Or at the very least ever since Hasbro restructured their enterprise and removed the boys toys phase and launched franchise, associate and portfolio manufacturers. Numbers from earlier than the restructuring usually are not comparable.

This after all means gross sales for Star Wars (Marvel and so on) motion figures have to be circling the drain. Now think about the insane 2024 costs and what meaning for precise unit gross sales.

Nonetheless, Hasbro continues to be the motion determine phase chief with 20% market share, a decline of 1.2 factors. However that after all contains manufacturers Hasbro owns or at the very least doesn’t should pay royalties for, like Transformers.

The patron merchandise phase (toys, video games) is way more quickly declining in Europe, -34% in comparison with a 14% decline within the US. Perhaps folks do have all of the Monopoly variations they might ever want in spite of everything.

Anyway, Chris Cocks is optimistic to succeed in his purpose of a companywide adjusted working revenue margin of 20% by 2027. The truth is, this may be extraordinarily simple to realize… simply do away with these pesky toys and video games enterprise altogether and develop into the Magic The Gathering firm, you’ll have pretty margins of virtually 40%.

Hasbro expecets that the Client Merchandise phase can be down for the total yr. Wall Road doesn’t appear to care. As a result of Hasbro paid $97 million in dividends to shareholders within the final quarter. I’m wondering what the fired Hasbro workers take into consideration that. Let’s hope they’re completely happy their lack of a job made some wealthy folks even richer. What an amazing “Operational Excellence” certainly.

Hasbro earnings report

Hasbro earnings presentation (PDF)

Hasbro earnings call transcript via The Motley Fool

Trending Merchandise