Final Thursday Hasbro offered their Q2 numbers. Chris Cocks is stuffed with reward in fact. Although client merchandise declined by one other 20% and so far as associate manufacturers are involved…. abysmal efficiency. Click through for a short summary and overview!

General income declined by 18%, most of which will be attributed to the sale of eOne, accounting for that income nonetheless declined by 6%.

Digital and Wizards of the Coast grew 20% nevertheless, and Hasbro is slowly shifting away from being a toys to being a video games firm. The truth is, Cocks is on report saying Hasbro is a video games first firm now. Toys turn out to be extra an afterthought for the corporate. And it is sensible from Hasbro’s standpoint, when digital and WotC has these implausible margins.

Working revenue margin is 25%. So Hasbro is on observe so far as margins are involved. A lot of that margin comes from the digital gaming phase and WotC nevertheless. For the complete yr Hasbro says WotC and digital could have a margin of 42%. Printing Magic playing cards is reasonable in spite of everything. And folks preserve shopping for them. However client merchandise (together with motion figures)? A paltry 4-6% margin is projected for the complete yr. So this push into digital and video games is sensible for Hasbro.

General income was $995.3 million. Digital and WotC now mainly account for nearly 50% of all income for Hasbro. This phase made $452 million alone and had a whopping $247.1 million working revenue, which is a margin of 54.7%! Even Apple’s margins aren’t that top. Compared client merchandise (aka “toys”, together with motion figures) returned a lack of $9.3 million. In different phrases: Magic the Gathering and digital gaming preserve Hasbro alive, conventional toys are extra of a millstone round Hasbro’s neck nowadays.

However now to the issues that ought to concern Hasbro so much. Shopper merchandise (aka “toys”) are down 20% and the phase continues to return a loss, which continues the pattern from the earlier earnings.

However what concerning the one factor that pursuits us probably the most? Associate Manufacturers aka “Star Wars”, “Marvel” and so forth?

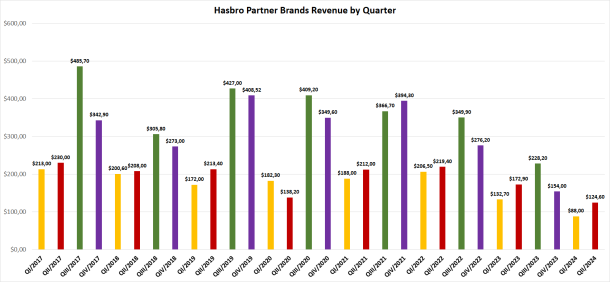

Income is $124.6 million. Which is a brand new low level for a second quarter. This can be a decline of 28%! 12 months so far associate manufacturers even declined by 31%. Official rationalization as per Hasbro is “Decline pushed by gentle leisure slate coupled with affect from exited licenses”. Which is identical Hasbro has mentioned for a couple of quarters now. In a earlier earnings name they admitted that about 50% of the decline will be attributed to exited licenses.

As you possibly can see that is Hasbro’s worst second quarter for his or her associate manufacturers in years, sadly, numbers from earlier than 2017 should not actually comparable as a result of Hasbro restructured their enterprise and dissolved the previous girls and boys toys segments and launched the brand new associate manufacturers phase.

Hasbro continues to be the market chief within the motion determine phase, however with a decline of three.5 factors, Hasbro nonetheless account for 23.6% of all the motion determine phase.

And Star Wars? Was neither talked about within the earnings report, nor the powerpoint presentation or the earnings name both actually. That is how issues are actually. Hasbro merely doesn’t speak about Star Wars anymore. Marvel was talked about two or 3 times, not the motion figures in fact, however apparently Hasbro needs to launch a Magic set based mostly on Marvel in 2025 which “followers are eagerly anticipating”.

It’s anybody’s guess how a lot of that $124.6 million associate manufacturers income was nonetheless made with Star Wars.

Oh, and GI Joe was talked about within the presentation as one of many toylines that grew for Hasbro.

Hasbro earnings report

Hasbro earnings presentation (PDF)

Hasbro earnings call transscript via The Motley Fool

Trending Merchandise