Earlier right this moment Disney launched their numbers for Q3/2023, which is Disney’s fiscal This autumn/2023, and for the complete fiscal 12 months. In case you are a type of who hope the Walt Disney Firm will crumble and die, I’ve dangerous information for you: complete income for the complete 12 months is $88.9 billion, a plus of seven% in comparison with 2022, and complete working revenue (earlier than taxes) is $12.86 billion, a plus of 6% in comparison with 2022.

With that Disney didn’t fairly meet expectations by analysts however nonetheless had a reasonably strong 12 months, all in all. Nonetheless in case you take a look at the main points there are some things that are considerably worrying or a minimum of not as nice. And sure, that features Disney+. Click through for more!

I gained’t bore you with a number of numbers right here. Simply this: Disney’s Parks & Experiences phase continues to be by far the most important cash maker for the corporate, whereas the Leisure phase (Streaming, Films, Linear Networks) generates extra income general – a bit greater than $40 billion for the complete fiscal 12 months – it’s Parks & Experiences which generates probably the most revenue, $8.9 billion, nearly 70% of Disney’s working revenue.

Disneyland had increased attendance within the final quarter, Disney’s cruise strains even have elevated income and revenue, whereas the closure of the Star Wars lodge had a detrimental affect on Walt Disney World’s revenue, in addition to considerably decrease spending by friends, Disney explains this with decrease lodge costs.

However let’s get to the issues that matter probably the most right here and are in all probability of most curiosity: how is Disney+ doing?

Disney and Hulu mixed report a lack of $420 million for the quarter. Which continues to be lots however one 12 months in the past the loss right here was $1.4 billion. Disney are nonetheless assured that the streaming enterprise will likely be worthwhile by the tip of 2024.

Disney doesn’t report the annual loss for simply Disney+ (and Hulu), just for their total direct to client enterprise, which additionally consists of ESPN. However right here Disney studies a lack of over $2.6 billion for the complete fiscal 12 months. Which continues to be a staggering quantity however a lot lower than the over $4 billion reported a 12 months in the past.

One cause for the slowly declining losses is a rise in common month-to-month income per subscriber for Disney+. Worth hikes present their impact. In North America common income is now $7.50, excluding India it’s $6.10 exterior North America. One 12 months in the past the common month-to-month income in North America was $6.10, so Disney elevated income by $1.40 within the US and Canada. And out of doors North America (excluding India, the place subscribers pay nearly nothing for Hotstar) it was $5.83 a 12 months in the past, so it’s a reasonable enhance of $0.27, that means a lot of the progress comes from North America.

However what about subscriber numbers? Disney+ added 6.9 million subscribers in complete worldwide (excluding India, once more, India is its personal market, India retains shedding subscribers, due to the lack of the Cricket, however subscription charges in India are negligible and subsequently the Indian market does not likely matter all that a lot). However nearly all of that progress comes from exterior North America. Right here Disney+ rotated issues a minimum of considerably after dropping subscribers up to now few quarters and added 500,000 subscribers. Which suggests exterior North America Disney+ gained 6.4 million subscribers (excluding India, the place Hotstar misplaced 2.8 million, however income is so low right here it barely makes a distinction).

Of their report Disney doesn’t present any 12 months over 12 months comparability for subscriber numbers, however after all the outdated studies are available and that is the place it will get considerably troubling for Disney.

As a result of one 12 months in the past Disney+ had 46.4 million subscribers in North America. One 12 months later it’s 46.5 million now. So subscriber numbers remained principally flat, they’re stagnating. Income progress and decreased losses are largely a results of increased charges.

In the meantime Disney+ added 9.6 million subscribers exterior the US (excluding India) up to now 12 months. Which is fairly wholesome, however a lot of that was added simply within the final quarter.

How does that evaluate with the competitors? Relating to variety of new subscribers Disney can nearly sustain with Netflix, Netflix added 8 million new subscribers within the final quarter in complete. Disney will not be that far off with 6.9 million (in case you account for India, the place they misplaced 2.8 million subscribers the full quantity is simply 4.1 million, simply half of what Netflix achieved).

However the actually fascinating piece of knowledge is what number of subscribers Netflix added in North America over the previous 12 months: 4 million. Whereas Disney+ added 100,000. Netlix’ crackdown on password sharing was an enormous success for the corporate, a lot in order that different streaming companies like Disney+ do the identical factor now. Netflix now has about 77 million subscribers in North America vs 46.5 million on Disney+.

Streaming companies are additionally closely invested in boosting their subscriber numbers for the advert supported service, as a result of you’ll be able to enhance month-to-month charges solely a lot earlier than you’ll expertise a large push again by clients, the truth is, a latest survey discovered that about 40% of all Netflix subscribers in North America take into consideration cancelling their subscription after latest worth will increase, both by outright cancelling or by perhaps switching to one of many decrease tiers, just like the advert supported tier. The advert supported tier has one huge benefit for streaming companies, it opens up the normal income stream offered by advertisers. However with that streaming companies may additionally lose their one huge benefit that drove individuals to them within the first place, an expertise uninterrupted by intrusive and annoying advertisements. However up to now Netflix, Disney+ and Co imagine clients are prepared to just accept advertisements in the event that they pay decrease costs in return. However in flip this might flip streaming into cable 2.0. A raffle, in my view.

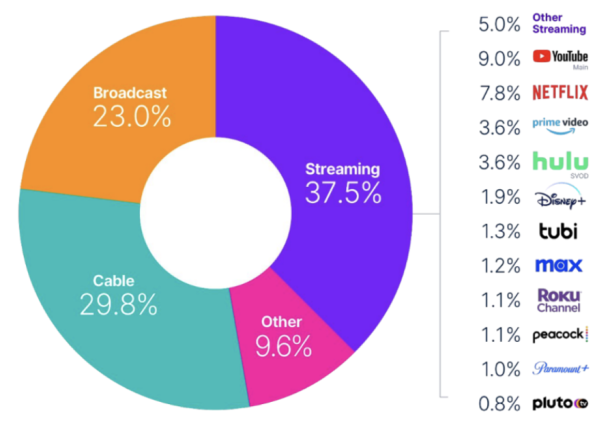

What else: Hulu has about the identical variety of subscribers in North America as Disney: complete quantity is 48.5 million. And right here follows an fascinating chart about market share which was included in Netflix’ data letter to shareholders that got here with the earnings report:

Right here you see a breakdown of the leisure market in North America. Streaming has the most important share in 2023. And Disney is in fifth place right here with 1.9% market share. Netflix has a whopping 7.8%. Netflix has about 77 million subscribers in North America. Which suggests Disney+ has about 60% of the client base of Netflix in North America… but Netflix has 4x the market share. Even Hulu, which has about the very same variety of subscribers as Disney+, has nearly double the market share!

What meaning is that the content material on Disney+ is just not doing nice. And the weekly Nielsen charts replicate this: you not often discover Disney content material on the charts, apart from Star Wars, Marvel, Bluey (not even Disney’s IP) and the occasional film nothing launched on Disney+ ever enters the charts. Now you don’t essentially have to have a ton of content material on the charts, when you’ve got a broad choice of issues individuals need to watch, Prime Video and Hulu are additionally not often discovered on the charts, solely with choose content material, however each have a a lot increased general market share.

So it stays to be seen if Disney+ will ever actually be a significant participant and true competitor of Netflix.

What else: Disney has no separate phase only for its films, it’s all lumped collectively within the Content material Gross sales & Licensing phase, however they reported a lack of $149 million right here and flat out said that that is due to Haunted Mansion. Disney’s film division won’t catch a break, as a result of The Marvels will likely be a colossal flop (field workplace projections are not often flawed as of late and early evaluations are largely detrimental as effectively), and in two weeks from now Want (the most recent animated film) is projected to be a flop as effectively, not as large as The Marvels, however given the manufacturing price range Want might at greatest break even worldwide, if in any respect.

So, the place does this go away issues? Disney won’t go bankrupt. Ever. In case you are a type of who hope Disney will die… you’ll wait eternally. Within the grand scheme of issues the film phase is simply not essential sufficient and even Disney+, which continues to be a cash sinkhole, solely creates a medium sized dent, as a result of so long as the theme parks and cruise ships work, Disney will swim in cash.

After all the large query is that if Disney+ will ever be successful story. We see dwindling rankings for the tentpole reveals, i.e. Marvel and Star Wars. And nothing else Disney is solely producing for the service ever makes the charts, apart from some theatrical films.

One other regarding truth is that advert income on Linear Networks is declining, which is a transparent signal that conventional television is slowly on the way in which out, most younger(er) individuals watch issues on streaming now.

Due to this fact Disney has a couple of points: will Disney+ actually be worthwhile in 12 months from now? Will subscriber progress in North America choose up once more or will it stay stagnant? Will Disney’s streaming market share enhance? Or will they nonetheless play fifth fiddle in a 12 months from now? Whereas Netflix pumps out hit present after hit present. Possibly Disney’s singular concentrate on Marvel and Star Wars is the most important weak spot, particularly when each franchises present indicators of weak spot and dwindling audiences on Disney+. They usually have completely did not create the rest that draws audiences. So Disney ought to rethink their content material technique.

Nonetheless: none of meaning Disney is in any critical hassle, sure they might make much more cash, however they nonetheless make loads of cash. Greater than $1 billion of revenue per thirty days within the final 12 months alone. That is the very reverse of going beneath.

Trending Merchandise